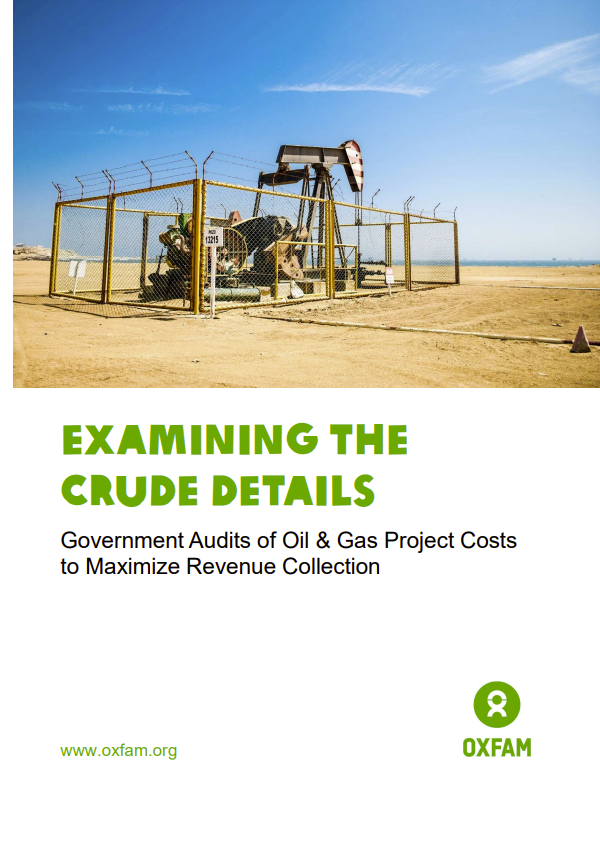

The petroleum sector offers governments huge potential revenues that could be invested in poverty alleviation and inequality reduction, but those revenues must first be collected. Taxes are levied on profits, but companies may seek to reduce their taxes by deducting ineligible or exaggerated costs, often paid to related parties. The petroleum industry, also known as the oil industry or the oil patch, includes the global processes of exploration, extraction, refining, transportation (often by oil tankers and pipelines), and marketing of petroleum products.

Governments’ essential tool to combat petroleum cost overstatement is the right to audit costs, but there is limited data on whether governments use this right effectively. Cost auditing practices in Ghana, Kenya, and Peru suggest that governments face significant challenges.

Oxfam proposes recommendations to address these challenges and ensure that governments collect the taxes owed for the exploitation of their finite, nonrenewable petroleum resources.

Raising revenues through taxes and other means is a critical government function. Governments need revenue to finance expenditures such as infrastructure investments and social services, including healthcare and education. Progressive taxation and progressive public spending are at the heart of fighting inequality and ending poverty. In many developing countries, however, despite concerted effort, revenue collection remains too low. The African Development Bank says African countries will need to increase the average ratio of taxes to gross domestic product (GDP) to 25 percent, up from 19.2 percent today, if they are to finance the continent’s infrastructure and human development needs.

The extractive industries—oil, gas, and mining—present an enormous opportunity to mobilize greater domestic revenues that could be used to close the gap between rich and poor. The petroleum sector in particular often generates enormous profits, and governments, as custodians of the resource, are entitled to the lion’s share. Even where oil and gas companies already contribute considerably to government revenues, it is possible that they should be contributing more. In practice, however, it is far from simple for developing-country governments to adequately administer their petroleum fiscal regimes and collect all that is due. Tax authorities may lack the necessary legal and regulatory tools, expertise, or information; furthermore, conflicting incentives or political pressures may complicate their mandate to maximize revenue collection.

Inflated company expenditures are a major threat to government revenues from oil and gas. The more costs that companies report, the less profits there are to tax, which means less revenue for government. Developing countries stand to lose the most from cost overstatement given their outsized reliance on corporate income tax. Companies may also seek to deliberately evade or avoid paying taxes. Avoidance is the use of legal (as opposed to illegal) methods to minimize the amount of income tax owed by a multinational corporation (MNC). An oil company’s recent tax scandal in Australia confirms that where companies obtain goods, services, and debt from other related companies held by the same MNC, there is a risk they will inflate the cost to reduce their own profits and shift profits offshore.

Oxfam and its allies have pushed to improve the fiscal governance of extractive industries, including through greater transparency and oversight. As shown by Oxfam’s past work assessing risks to revenues, one critical area in need of strengthening is the effectiveness of government fiscal audits.

Petroleum-producing countries must ensure they capture an appropriate share of the value of their oil and gas if they are to meet domestic revenue mobilisation (DRM) targets—otherwise millions could be lost. In two separate examples, auditors found that oil and gas companies had overstated their costs by $127 million in the Republic of Congo and by $81 million in Uganda. Substantial revenue was lost as a result—$63.5 million in Congo and $24 million in Uganda (see “Introduction”). This study identifies several challenges to effective petroleum cost auditing in Ghana, Kenya, and Peru, which may also be relevant to other petroleum-producing countries:

• Laws determining the treatment and eligibility of petroleum costs are inadequate, and changes may be difficult to apply. An audit is only as effective as the law it seeks to enforce. Legal loopholes and costs that are prone to abuse may limit auditors’ ability to protect government revenues.

• Institutional fragmentation hinders effective revenue administration. Cost audit rights are often dispersed across multiple government agencies, sometimes with conflicting mandates. Inadequate coordination inevitably leads to duplication of effort and uncertainty for investors with respect to the final determination of gross income.

• Auditors lack sector-specific knowledge and expertise. The lack of regular risk assessment relating to the petroleum sector reflects tax authorities’ limited appreciation of the special characteristics of the industry. Despite this gap, neither Ghana nor Kenya has made use of the option reserved for them in many petroleum agreements to outsource – partly at the contractor’s expense – inspection of the company’s accounts to external auditors.

• It is difficult to obtain data to benchmark petroleum costs. Reporting requirements are unclear or incomplete, preventing governments from accessing certain information from companies. Still, efforts are underway globally to expand the pool of publicly available data specifically for petroleum costs.

• Audits are too late. There is a tendency to prioritize auditing only once oil is flowing, long after development of the oil field has started. By that time, the government’s audit rights may have expired and companies’ legal obligation to keep records may have run out.

• Transparency and public accountability are absent with respect to cost auditing. The information available publicly does not provide a sufficient basis by which to judge how governments are using their cost-auditing rights. Unless a case goes to court, citizens have no idea whether a government is auditing costs or what the results might be. Supreme audit institutions (SAIs), national legislatures, independent commissions, and Extractive Industries Transparency Initiative (EITI) multistakeholder groups could all potentially review cost-auditing practices, but these actors have not commonly done so.