Big business is able to take advantage of loopholes in global tax laws and avoid tax on a massive scale. This deprives governments around the world of the money they need to tackle poverty and inequality. Tax avoidance is the legal usage of the tax regime in a single territory to one’s own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. It means there is less for them to invest in healthcare, education, and jobs.

This report examines the failings of the global tax system that facilitate mass tax avoidance. It looks at one example of a multinational company (MNC) that Oxfam thinks is not paying its fair share. It calls on governments and businesses to implement the reforms that are needed to stop MNCs from avoiding paying their fair share of tax in the future.

SUMMARY

In January 2017, Oxfam revealed that just eight men own the same amount of wealth as the 3.6 billion people who form the poorest half of the world’s population.1 This stark statistic illustrates the scale of an inequality crisis that undermines the fight against poverty around the world. This report examines one of the key drivers of this inequality crisis: the broken tax system that allows multinational companies (MNCs) to systemically avoid tax, robbing countries – rich and poor – of revenue that should rightly be invested to address poverty. Using new research, this report looks at an FTSE 100 MNC, RB (formerly Reckitt Benckiser), the maker of household-name brands such as Vanish, Durex, and Dettol, as an example of an MNC that Oxfam thinks is not paying its fair share of tax. This report looks at the impact tax avoidance by MNCs can have on developing countries and identifies clear actions governments and MNCs can take to act in the interest of their citizens and fix the broken tax system.

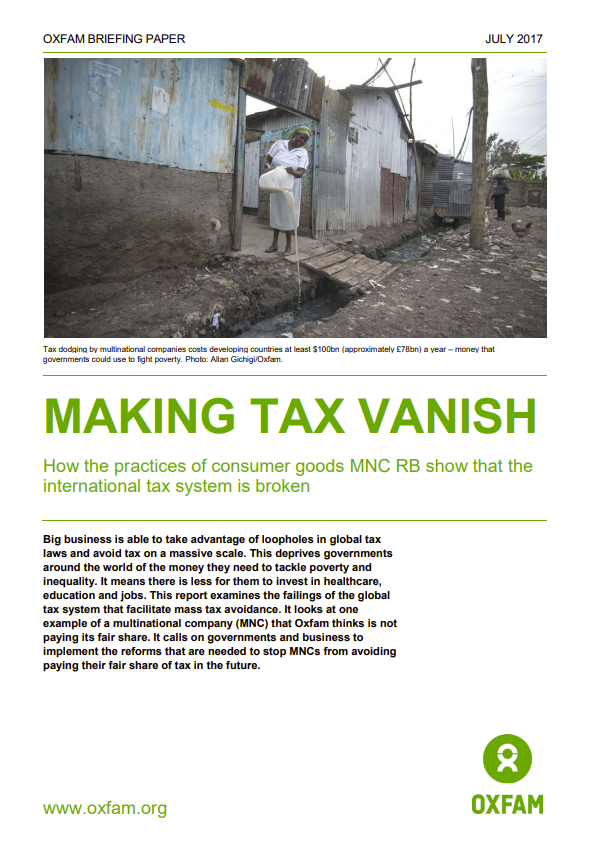

HITTING THE POOREST HARDEST

Taxing the profits of companies is one of the most progressive forms of taxation. However, MNCs, in particular, can take advantage of a broken and outdated international tax system to avoid paying their fair share. This deprives governments around the world of the revenue they need to address poverty and invest in healthcare, education, and jobs. As a result, tax avoidance hits the poorest the hardest: when public services such as health and education are cut because of low tax revenues, poor people who cannot afford to pay for private services either miss out or are pushed into debt. Reduced quality and accessibility of these essential services mean that women and girls often fill the gap through unpaid or low-paid care work. 2 Societies become more unequal, as it becomes harder for those at the bottom to improve their lives and escape poverty. This is especially true in developing countries, where corporate tax revenues account for a higher share of overall revenue. Tax avoidance by MNCs using tax havens3 is estimated to cost developing countries at least $100bn (approximately £78bn) every year.

MAKING TAX VANISH

Oxfam identified RB as a case study for this report through research that surveyed publicly available accounts for FTSE 100 companies that matched preliminary search criteria, looking for evidence of international business activities that may have tax implications (see Appendix 1 for full methodology).

RB is a leading MNC producing products for ‘health, hygiene, and home’. It is a highly successful FTSE 100 company, generating £10bn of revenues in 2016, and its products are sold in over 200 countries. However, Oxfam’s research suggests that RB is not paying its fair share of taxes. Oxfam is not suggesting that RB has done anything illegal in reducing its tax bills, but the impact of the shortfall in tax revenues means that less money is potentially available for governments to spend on essential public services, an impact felt most keenly in developing countries. RB says that it ‘pays the right amount of tax in each country where we do business around the world’, and that it ‘complies with all our legal obligations and seeks to do what is right by all the company’s stakeholders (see Appendix 2 for RB’s full response).