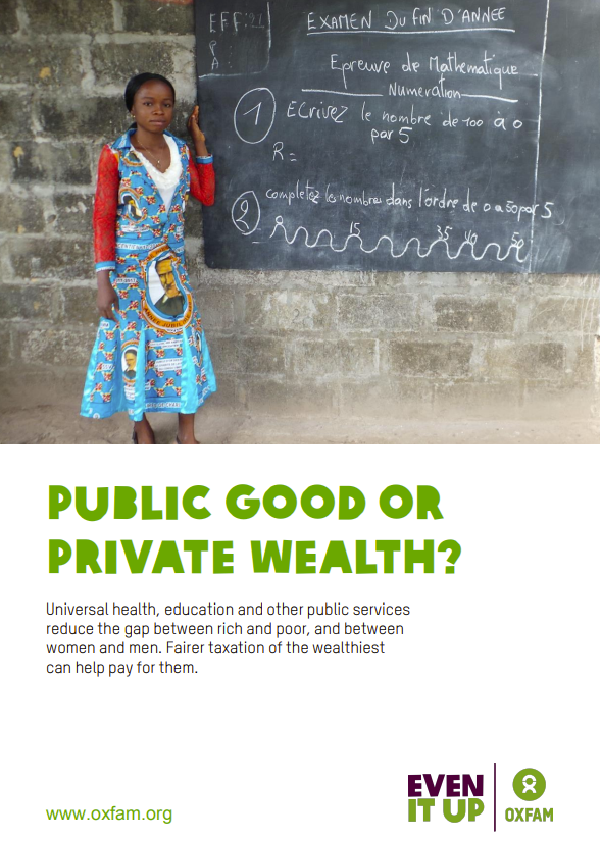

Public good or private wealth?

Universal health, education, and other public services reduce the gap between rich and poor, and between women and men. Fairer taxation of the wealthiest can help pay for them.

Our economy is broken, with hundreds of millions of people living in extreme poverty while huge rewards go to those at the very top.

The number of billionaires has doubled since the financial crisis and their fortunes grow by $2.5bn a day, yet the super-rich and corporations are paying lower rates of tax than they have in decades. The human costs – children without teachers, clinics without medicines – are huge. Piecemeal private services punish poor people and privilege elites. Women suffer the most, and are left to fill the gaps in public services with many hours of unpaid care.

We need to transform our economies to deliver universal health, education and other public services. To make this possible, the richest people and corporations should pay their fair share of tax. This will drive a dramatic reduction in the gap between rich and poor and between women and men.

Governments should listen to ordinary citizens and take meaningful action to reduce inequality. All governments should set concrete, timebound targets and action plans to reduce inequality as part of their commitments under Sustainable Development Goal (SDG) 10 on inequality. These plans should include action in the following three areas:

1. Deliver universal free health care, education and other public services that also work for women and girls. Stop supporting privatization of public services. Provide pensions, child benefits and other social protection for all. Design all services to ensure they also deliver for women and girls.

2. Free up women’s time by easing the millions of unpaid hours they spend every day caring for their families and homes. Let those who do this essential work have a say in budget decisions and make freeing up women’s time a key objective of government spending. Invest in public services including water, electricity and childcare that reduce the time needed to do this unpaid work. Design all public services in a way that works for those with little time to spare.

3. End the under-taxation of rich individuals and corporations. Tax wealth and capital at fairer levels. Stop the race to the bottom on personal income and corporate taxes. Eliminate tax avoidance and evasion by corporates and the super-rich. Agree to a new set of global rules and institutions to fundamentally redesign the tax system to make it fair, with developing countries having an equal seat at the table.

Mukesh Ambani ranks 19th on the Forbes 2018 billionaire list and is the richest Indian. His residence in Mumbai, a towering 570-foot building, is worth $1bn and is the most expensive private house in the world.

Pratima, who lives in a slum in Patna, eastern India, lost both her twins due to delays and scarce resources in her nearest clinic. Poor women like Pratima have to give birth without proper maternal healthcare, leaving them vulnerable to complications, neglect, and stillbirth a result.

Jeff Bezos, the founder of Amazon, is the richest man in the world, with a fortune of $112bn on the 2018 Forbes list. Just 1% of his total wealth is the equivalent of almost the whole health budget of Ethiopia, a country of 105 million people. He recently said that he has decided to invest his fortune in space travel, as he can’t think of anything else to spend his money on.

Zay is a shrimp processing worker in Thailand. The shrimp Zay peels is supplied to large retailers like Whole Foods supermarkets, now owned by parent company, Amazon. At the end of a shift, the exhaustion Zay feels after peeling shrimp for 12 or 13 hours can leave him almost immobile. ‘They are using the workers,’ says Zay. Zay is lucky if he earns more than $15 in a day.