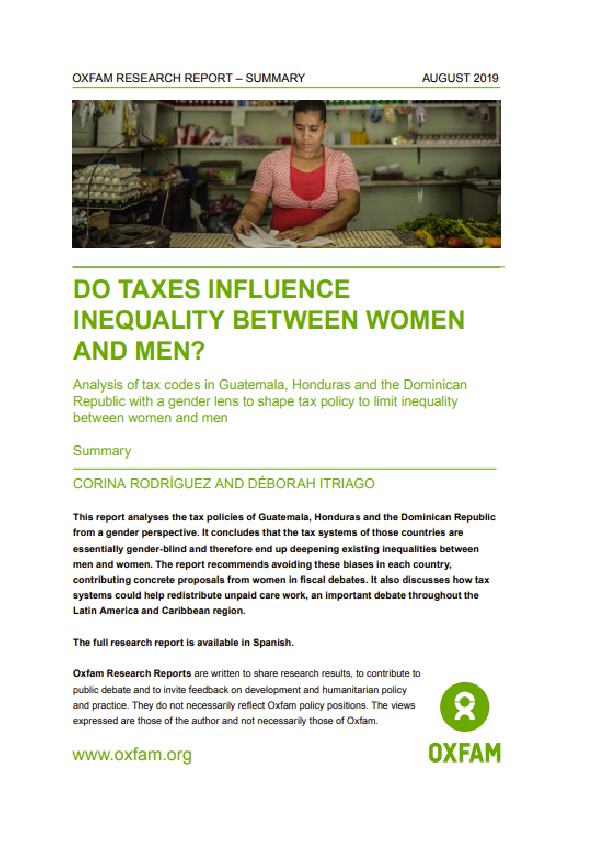

This report analyses the tax policies of Guatemala, Honduras and the Dominican Republic from a gender perspective. It concludes that the tax systems of those countries are essentially gender-blind and therefore end up deepening existing inequalities between men and women. The report recommends avoiding these biases in each country, contributing concrete proposals from women in fiscal debates. It also discusses how tax systems could help redistribute unpaid care work, an important debate throughout the Latin America and Caribbean region.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs.

Oxfam Research Reports are written to share research results, to contribute to public debate and to invite feedback on development and humanitarian policy and practice. They do not necessarily reflect Oxfam policy positions. The views expressed are those of the author and not necessarily those of Oxfam.

From the standpoint of feminist economics, fiscal policy produces effects and impacts on the lives of women just as any other policy that is designed and implemented in contexts that are still heavily shaped by gender stereotypes. Traditional and preconceived ideas regarding the roles of men (as providers of household income) and women (as caretakers of the household and its members) in society are the basis for much fiscal policy.

Either one of the two components of fiscal policy – taxation and spending – may further entrench gender relations in which women are subordinate to men, with negative consequences for women’s economic autonomy over the course of their lives and for the fight against gender inequality.

Gender analyses in Latin America and the Caribbean have focused more on studying the impacts of public spending policy on gender equality than on those of tax policies. This report seeks to reveal the gender implications of tax policy design in Guatemala, Honduras) and the Dominican Republic. While it is limited in scope, the proposals included in this report are relevant not only for the three countries analyzed, but also useful for the whole of the Latin America and Caribbean region and contribute to discussions about the potential of tax policy to help reduce gender inequalities in the region.

Oxfam’s research for this report analyzed whether there are explicit or implicit biases in the tax rules through a documentary analysis with a gender perspective, and then looking at the situation of men and women in each country with respect to levels and sources of income, property, consumption and labor. The research also assessed whether taxes have relatively more impact according to the level and source of income and labor, calculating effective income taxation rates in specific examples and then cross checking with official statistics on where most men and women are located.

The tax cost of corporate tax incentives and how much the investment could increase to reduce inequalities between men and women was also analyzed. Finally, different options for tax policies were looked at which could help to make visible, value and redistribute unpaid care work, assessing the advantages and disadvantages.