Hydropower, also known as water power, is the use of falling or fast-running water to produce electricity or to power machines. This is achieved by converting the gravitational potential or kinetic energy of a water source to produce power. Hydropower is a method of sustainable energy production.

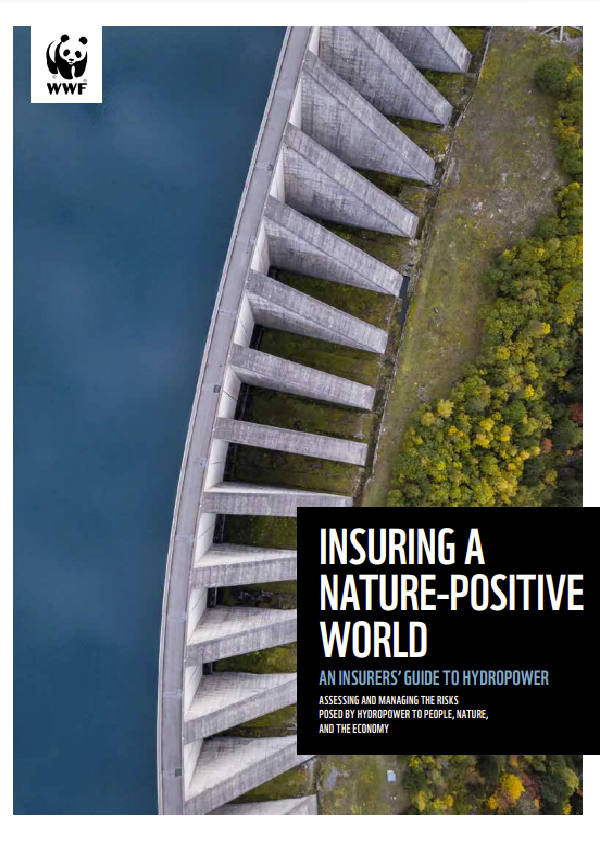

Hydropower dam projects are complex, costly, and devastate the potential benefits that healthy, free-flowing rivers provide, including a source of food for people and animals, habitat space, and a climate crisis solution. This first-of-its-kind guide to hydropower insurance was developed by WWF with the support of the UN Environment Program’s Principles for Sustainable Insurance to facilitate sustainable infrastructure projects and prevent high-impact hydropower projects for the long-term protection of rivers.

A recent study demonstrated that nearly two thirds of the world’s longest rivers are no longer free-flowing, and that hydropower dams are the primary cause. This loss of river connectivity is one of the major reasons behind the 84 per cent collapse in freshwater species populations since 1970. Plans for an estimated additional 3,700 hydropower dams threaten most of the world’s remaining free-flowing rivers and the diverse benefits they provide societies, economies, and ecosystems.

Whereas previously the financial sector’s focus has been largely on carbon emissions, the topic of biodiversity has recently gained increased visibility and momentum in the sector. The post-2020 global biodiversity framework recognizes that urgent action is required to transform economic, social, and financial models to halt biodiversity loss by 2030 and allow for the recovery of natural ecosystems, with net improvements by 2050. The insurance industry is set to play an important role and is currently rallying around the goal of a nature-positive insurance sector. Although we recognize that hydropower still has a role to play (although very different from just one decade ago, see Connected and Flowing4 ), support for high-impact hydropower is incompatible with such commitments and hydropower must be screened very carefully.

In addition to their impact on nature, hydropower projects are frequently controversial and high risk, impacting both local and downstream communities, and resulting in local and international opposition, as well as scrutiny from the press, NGOs, and governments. As a result, support for high-impact hydropower projects put insurers’ reputations on the line.

Insurance companies act as risk managers, insurers, and investors, and provide support for the development of hydropower projects in all three of these roles. Hydropower projects are complex and costly infrastructure projects. In most cases, private companies will not engage in the construction of new hydropower projects without insurance coverage, and private investors will insist on relevant insurance being in place before committing to invest.

Insurers therefore play a key role in facilitating the hydropower sector and their support is urgently needed to prevent high-impact hydropower projects. They can act in several ways:

1. Support the transition to low-carbon, low-cost, and low-conflict energy by favouring renewable energy projects that are part of an integrated, system-wide renewable energy plan;

2. Create a company ESG policy for underwriting, and investments in, hydropower;

3. Decline cover for hydropower projects in Protected Areas;

4. Require an independent and credible social and environmental impact assessment;

5. Require that stringent frameworks and standards are applied;

6. Require calculations of a project’s greenhouse gas emissions and set a maximum threshold; and

7. Consistently screen hydropower as a potential controversial activity in investment decision making.

Knowledge of the impacts of hydropower on people and nature is becoming clearer. At the same time, our understanding of its role in achieving an energy sector in line with limiting global warming to 1.5 degrees above pre-industrial levels is evolving. This guide provides an initial view of actions that insurers can take to protect nature and prevent high-impact hydropower. However, the recommendations will be adjusted over time as knowledge on both these topics develops. WWF welcomes the inputs of insurers as it continues to work on this topic.